Mortgage communications are complex. Stringent regulations, legacy systems, and multiple stakeholders in the mix make it challenging for Mortgage Servicers to efficiently create, update, and manage communications. Messagepoint’s intelligent content hub is a mortgage servicing solution that enables content owners to take back control of their communications across all channels, streamlining content authoring, collaboration, and approvals to significantly reduce cycle times.

Watch the webinar replay to learn how mortgage servicers can take back control with a modern approach to managing borrower communications and transform this burden into a competitive advantage.

Watch the replay

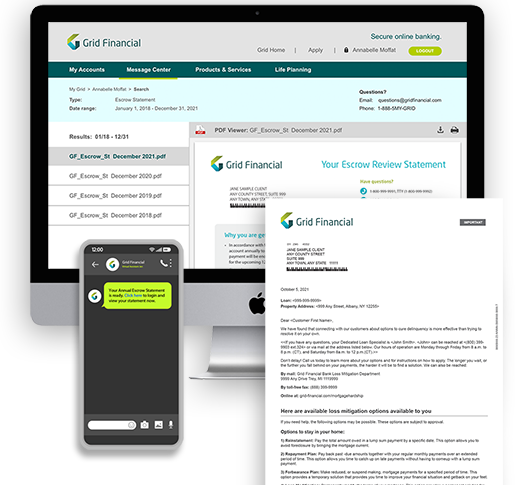

Reduce cycle times by putting the days of waiting on IT and third-parties behind you. With Messagepoint, the entire authoring, editing, and targeting process can be accomplished by non-technical business teams using our intuitive and code-free UI. Your teams gain full control and visibility, streamlining your core processes for communication authoring and generation across all channels.

Tired of maintaining and updating hundreds of individual templates for a single correspondence? Messagepoint lets you build a master touchpoint that shares its structure, text, and graphics with its variations. Each variation can have its own unique content (such as content variations required by state regulations) but inherits shared layouts and content from the master. Spin up a new communication in seconds or make a global change to the master (such as a logo) that is reflected in all its variations in a few mouse clicks.

It’s hard to keep borrower communications compliant with the ever-changing landscape of state and federal regulations. Messagepoint’s advanced content sharing and management capabilities enables you to know where changes are needed and updates them with a single change using language that’s been approved within Messagepoint by your legal and compliance teams. Full audit trail and version control capabilities keep track of all the details.

Keeping borrowers happy increasingly depends on being able to access statements, notices, and correspondence on the channels they are most comfortable with. Using Messagepoint, you can centrally manage all your content and communications for both print and digital channels and prep your documents for technologies like e-signature. What’s more, you can ensure documents are successfully delivered to clients on their preferred channel.

Messagepoint is so much more than a powerful content management hub. Start by effortlessly migrating your content off legacy systems, then clean and optimize it using Messagepoint’s AI-powered content rationalization engine. Once content is ready to be shipped, Messagepoint’s composition engine allows business users to manage both batch and on-demand jobs. From there, Messagepoint’s highly scalable Enterprise Communications Processing solution can ensure communications are delivered and then archived as needed.

Ensuring borrowers receive accurate and up-to-date information is critical. Unfortunately, the technology and processes some mortgage servicers use…

Read the article

Watch this webinar replay and learn how organizations can modernize borrower communications processes to accelerate authoring cycles, streamline…

Watch the video

For most mortgage servicers, the processes associated with creating and updating borrower communications are slow, cumbersome, costly, and…

Read the whitepaper